Close Brothers Invoice Finance vs Cynergy Business Finance

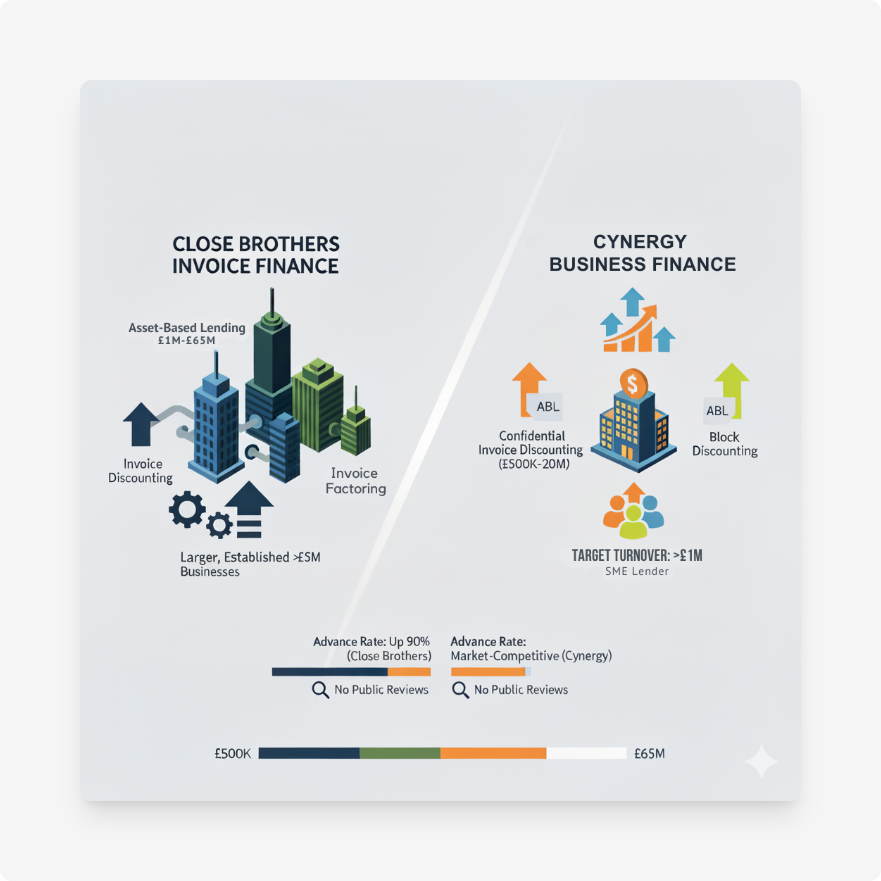

This guide compares two established UK providers of invoice financing for SMEs. We look at products, costs, eligibility, speed and service. It is written for owner‑managers, FDs and advisers weighing a change of facility or planning a first‑time line. We reference live sources and add worked examples so you can see the cash‑flow impact in practice. Close Brothers Invoice Finance and Cynergy Business Finance both fund up to a high percentage of invoice value, but they suit different scenarios.

Invoice finance trade‑offs at a glance

This dashboard compares Close Brothers Invoice Finance and Cynergy Business Finance on pricing, limits, terms, speed, fees and user experience. Read each tab as a single metric: bars show the range you might be quoted; dots or lines show typical points or fastest paths. Use it to shortlist today: if you need headroom and ABL depth, Cynergy trends higher on limits; if you want a mature portal and factoring options, Close is strong. Decide by matching your facility size, appetite for documentation, and how quickly you must draw.

Products and Terms at a Glance

Close Brothers overview, loan sizes, fees, repayment style, terms, eligibility

Close Brothers Invoice Finance provides invoice discounting, factoring and asset‑based lending to UK SMEs. Typical advances go up to 90% of eligible invoices. Pricing usually combines a service fee for administration with a discount margin (interest on funds in use). Repayments are self‑liquidating as customers settle invoices; the remaining balance, net of fees, is released back to the business. Eligibility for invoice discounting commonly includes a minimum turnover of £750,000 per annum and B2B trade on credit terms. Sources: Close Brothers site (advance rate and fee structure), and product page (turnover criterion).

- Products: confidential invoice discounting, factoring, asset‑based lending.

- Advance rate: up to 90% of invoice value.

- Fees: service fee + discount margin; bad debt protection available on some facilities.

- Eligibility: B2B invoicing; min turnover often £750k+ for discounting; broader range via factoring.

- Tech: IDeal™ online portal for uploads, availability and draws.

Evidence: advance and products Close Brothers Invoice Finance; fee structure Our fees; invoice discounting eligibility and 90% advance Invoice Discounting; Close Group overview Invoice Finance; IDeal portal references IDeal overview.

Pros of Close Brothers

- High touch service with direct access to underwriters; quicker decisions on nuances.

- Mature portal (IDeal™) integrates with accounting software, helping reconciliation and real‑time availability.

- Full suite: factoring if you want outsourced collections; ABL for extra headroom.

- Well‑capitalised FTSE‑listed parent supports stability and continuity.

Evidence: service approach Our service; portal details IDeal overview; group context Close Brothers Group.

Cons of Close Brothers

- Eligibility can be tighter, especially for confidential discounting (e.g. £750k turnover guidance).

- Service fees plus margin can price higher than stripped‑back fintech options for micro facilities.

- Onboarding involves diligence on debtor quality and concentrations; setup can take longer for complex ledgers.

Cynergy Business Finance overview, loan sizes, fees, repayment style, terms, eligibility

Cynergy Business Finance (CBF) is the asset‑based lending arm of Cynergy Bank. It provides invoice discounting and broader ABL lines against receivables, inventory, plant and property. Public guidance from UK Finance and Cynergy indicates target facilities in the £500,000 to £25 million range for eligible customers. Advances can reach around 90% of invoice value, with funds typically released within 24 hours once approved. Pricing is bespoke, using a service fee plus discount margin on funds drawn. Repayments self‑liquidate when debtors pay. Sources: Cynergy BF webpage; UK Finance profile; British Business Bank ENABLE guarantee announcement; third‑party overviews of advance speeds.

- Products: confidential invoice discounting; ABL lines secured on receivables, stock, plant, property; selective cash‑flow loans alongside IF.

- Facility size: typically £500k–£25m.

- Advance rate: up to ~90% of invoice value, subject to eligibility and concentration limits.

- Fees: service fee + discount margin; documentation reflects standard ABL conditions.

- Eligibility: established B2B firms with auditable ledgers; often suited to larger or fast‑growing SMEs.

Evidence: CBF overview Cynergy Business Finance; funding range and ABL scope UK Finance profile; ENABLE Guarantee for CBF’s invoice finance book British Business Bank press release; typical advances within 24 hours once approved British Business Bank explainer and Capitalise overview.

Pros of Cynergy Business Finance

- Strong appetite for larger requirements; can structure multi‑asset borrowing bases.

- Backed by Cynergy Bank, with additional support via the British Business Bank’s ENABLE Guarantee for its invoice finance lending in 2025.

- Relationship‑driven approach; bespoke facilities for growth, acquisitions and turnarounds.

- Can add cash‑flow loans to complement receivables funding.

Cons of Cynergy Business Finance

- Less targeted at micro facilities; smaller ledgers may be better served by specialist small‑ticket providers.

- ABL documentation and monitoring can be heavier than a simple factoring line.

- Pricing and covenants are bespoke; more negotiation and legal work at the outset.

Costs and Repayments in Practice

Both lenders use the standard invoice finance pricing model: a service fee (to manage the facility and ledger) plus a discount margin applied to funds in use until debtors pay. Close Brothers explicitly describes a service fee covering account management and administration. Industry guidance indicates advances are commonly made within 24 hours after invoice submission, with the remainder released, minus fees, when the customer pays.

Sources: Close fees page; Close product and advance pages; UK Finance profile for Cynergy; British Business Bank guidance on how invoice finance is advanced and settled.

Worked example: Close Brothers

Assumptions A wholesaler invoices £300,000 a month on 60‑day terms. Eligible advance is 90%. We assume a 1.5% service fee p.a. on turnover and a 9.0% discount rate (example only) on average funds in use. These are illustrative UK SME figures; actual quotes depend on risk, ledger quality and market rates.

- Funds in use: roughly two months’ invoices × 90% = £540,000 × 90% of £600,000 ledger ≈ £540,000.

- Monthly discount cost: £540,000 × 9.0% / 12 ≈ £4,050.

- Monthly service fee: £300,000 × 1.5% / 12 ≈ £375.

- Total indicative monthly cost: ~£4,425.

Cash‑flow effect: immediate access to £270,000 on each £300,000 billing cycle, with the balance released on collection, net of fees. Close publishes the two‑part fee model and up to 90% advance on its site.

Worked example: Cynergy Business Finance

Assumptions A manufacturer invoices £1,000,000 a month on 60‑day terms. Eligible advance 90%. We assume a 1.25% service fee p.a. on turnover (large ledger) and an 8.5% discount rate (example only) due to stronger debtor quality and ABL structure.

- Funds in use: roughly £1,000,000 × 2 months × 90% = £1,800,000.

- Monthly discount cost: £1,800,000 × 8.5% / 12 ≈ £12,750.

- Monthly service fee: £1,000,000 × 1.25% / 12 ≈ £1,041.

- Total indicative monthly cost: ~£13,791.

Cash‑flow effect: immediate access to £900,000 each month. Where needed, CBF can layer inventory or plant & machinery lines to lift overall headroom within an ABL structure.

Reminder: These examples use clearly stated assumptions. Actual pricing depends on risk, dilution, debtor quality, sector, concentration and SONIA/Base Rate at the time.

Speed and Service

Both providers can release funds within 24 hours of invoice submission once the facility is live, because invoice finance is designed to advance a percentage of invoice value quickly and then reconcile on payment. Close emphasises direct access to underwriters and a dedicated manager model. Its IDeal™ portal integrates with accounting packages to streamline availability and reconciliations. Cynergy is relationship‑led and, in 2025, gained an ENABLE Guarantee from the British Business Bank to support its invoice finance lending, signalling ongoing capacity for the product. Allow one to three weeks to set up a straightforward facility, with more time for full ABL or legal security over multiple assets.

Evidence: British Business Bank invoice finance explainer (24‑hour funding once approved); Close service and IDeal references; British Business Bank press release on Cynergy’s ENABLE Guarantee.

Who Each Lender Suits

Typical scenario for Close Brothers

You are an established B2B wholesaler or distributor with £2m–£20m annual turnover. You want confidential discounting with a robust portal and a named manager. You may add bad debt protection or step into factoring if you want outsourced credit control. You value a lender that can flex into ABL as you scale.

Typical scenario for Cynergy Business Finance

You are a fast‑growing manufacturer or services group with complex needs. Facility size is £500k–£10m+. You may be acquisitive or working through a turnaround. You want invoice discounting anchored by an ABL borrowing base on stock, plant or property for headroom. You are comfortable with bespoke covenants in exchange for capacity.

How to Apply

Application steps and documentation required for each lender

Close Brothers

- Initial enquiry with summary of trading, sector, debtor mix and facility sought.

- Information pack: latest filed accounts, recent management accounts, aged debtor and creditor lists, sample invoices/POs, details of disputes and credit control process.

- Indicative terms and site or virtual meeting with an underwriter.

- KYC/AML and legal: debenture and notice of assignment; optional credit insurance if taking bad debt protection.

- Go‑live: connect IDeal™, upload ledgers, first draw.

Close sets out the pricing structure and portal access on its site; the exact checklist is tailored per deal.

Cynergy Business Finance

- Discovery call covering funding purpose (growth, acquisition, turnaround) and collateral mix.

- Data pack: accounts, management MI, aged AR/AP, top debtors, contracts, stock and asset schedules if ABL headroom is required.

- Indicative proposal, then term sheet subject to field survey and legal due diligence.

- Documentation uses standard ABL terms, including variation and increased‑costs clauses typical to the product class.

- Go‑live and first availability calculation; draws thereafter usually within 24 hours.

Evidence: CBF ABL standard conditions publicly available; UK Finance profile describes the multi‑asset scope and use cases.

Final Verdict: Which Lender Fits Your Business Best

Choose Close Brothers if…

- You need a high‑service confidential discounting or factoring line with a proven portal.

- Your turnover is £750k+ and ledger quality is good, but you still want access to factoring if collections help is needed.

- You prefer a long‑standing UK bank group with dedicated managers and quick credit access.

- You may add ABL later but do not need a complex multi‑asset structure on day one.

Choose Cynergy Business Finance if…

- You require £500k–£25m of headroom and want the option to fund receivables, stock, plant or property together.

- You are growing fast, acquiring, or in a turnaround and need a bespoke structure with relationship‑led monitoring.

- You want room to bolt on cash‑flow loans alongside the invoice line.

- You are comfortable with fuller ABL documentation and a negotiated covenant package.

Both lenders are credible choices for UK SMEs using invoice financing to smooth cash flow. The decision comes down to size, complexity and desired service model. If you want help comparing the market, speak to Funding Agent or send a brief via our enquiry form.

Sources

- Close Brothers Invoice Finance – homepage and product overview

- Close Brothers – Our fees (service fee explanation)

- Close Brothers – Invoice Discounting (90% advance; £750k turnover guidance)

- Close Brothers Group – Invoice Finance (products: discounting, factoring, ABL)

- Close Brothers – Our service (decisioning and access to underwriters)

- Close Brothers Commercial Finance IE – IDeal™ portal overview

- Cynergy Business Finance – official page

- UK Finance – Invoice Finance & ABL (CBF profile and £500k–£25m indication)

- British Business Bank – £100m ENABLE Guarantee with Cynergy Bank (supports CBF invoice finance lending)

- British Business Bank – Invoice finance explained (advance within ~24 hours once approved)

- Capitalise – Top invoice finance providers 2025 (context on Close and Cynergy; advance speed)

- Cynergy Business Finance – Standard conditions for ABL (England & Wales)

.png)