How to improve your business Credit Score in 2026

Your business credit score affects how much you can borrow, the price you pay for finance, and the trust suppliers place in you. Many UK business models use a 0 to 100 range, where a higher number signals lower risk to lenders. Aim high, manage risk, and show steady, accurate information. See overviews from Barclays and Experian.

Why your business credit score matters in 2026

Lenders, insurers, and major suppliers review your score when they set limits and prices. A stronger score can increase the amount you can borrow, improve your interest rate, and raise your approval chances. In a tight credit market, good scores save money and open doors. For a quick primer, see the British Business Bank guide.

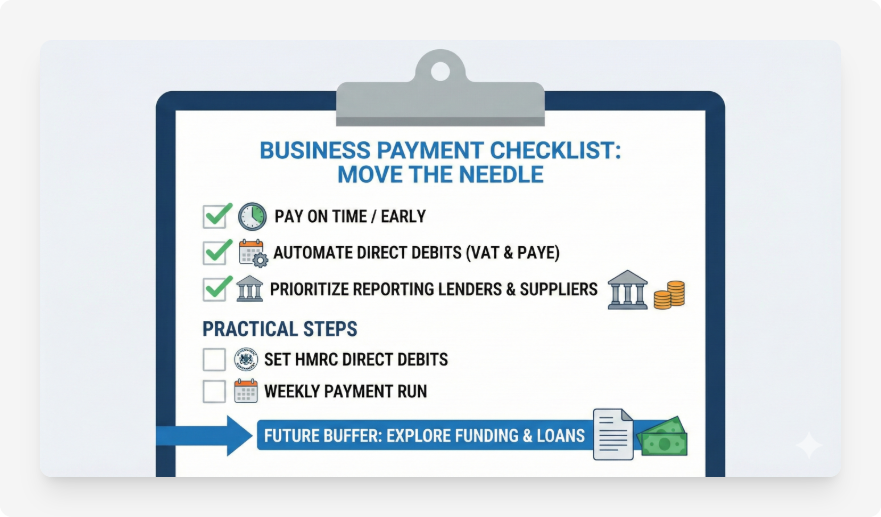

Payment habits that move the needle

Pay on time, or a bit early. Consistent on-time payments signal low risk and have a strong positive effect on your score. If cash flow is tight, pay the accounts that report to credit bureaus first. Automate with direct debits to avoid slips. Time Finance shares practical steps in this guide.

- Set up Direct Debits for VAT and PAYE with HMRC, use the official pages for VAT and PAYE.

- Create a weekly payment run to catch errors before due dates.

- Focus first on lenders and suppliers that report your behaviour.

Want more buffer in the future, explore funding options and basics in our internal guides on equity finance and business loans.

Manage credit, do not let it manage you

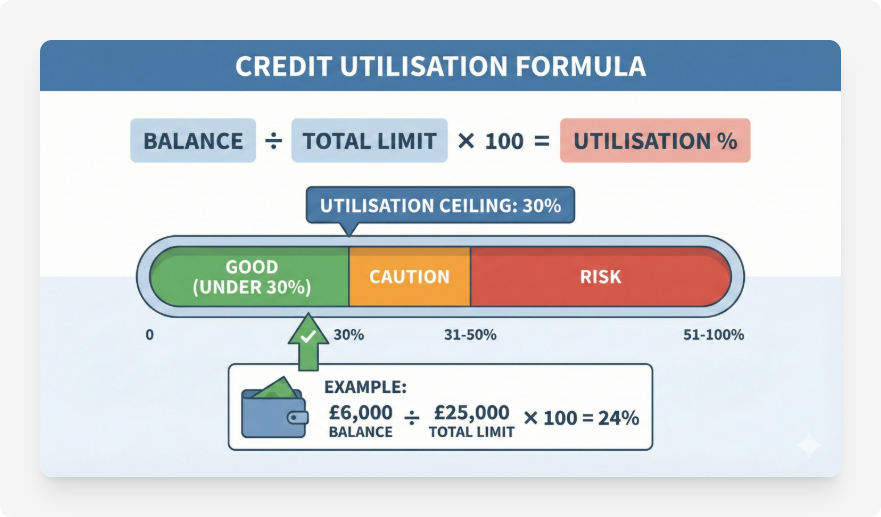

Keep utilisation low. Use under 30 percent of your total business credit limits. Avoid bursts of new applications, since many hard searches in a short period can look risky to lenders. Using business credit products sensibly helps you build history over time. D&B outlines smart steps in this resource.

Utilisation formula: balance ÷ total limit × 100. Example, £6,000 balance on £25,000 total limits gives 24 percent utilisation.

If you need headroom, ask for a limit increase on an existing account rather than opening several new lines at once. This can reduce utilisation without extra hard checks.

Related reading, our primers on invoice finance and cash flow management show ways to smooth working capital without spiking utilisation.

File full, file early, stay consistent

File full accounts where possible and keep your Companies House and HMRC records current. Lenders value complete and consistent data when they review your business. Update addresses, directors, SIC codes, and trading status as soon as they change. Use Companies House services to file your company accounts and review the full versus abridged accounts guidance.

If you plan to seek new finance, prepare early. Our guide on how to prepare accounts for lenders explains what funders want to see.

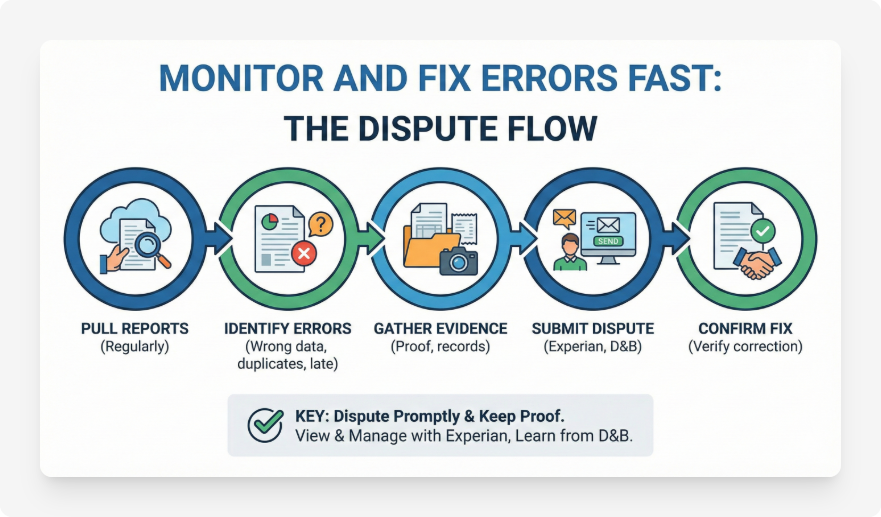

Monitor and fix errors fast

Check your commercial credit reports on a regular cycle. Look for wrong addresses, old directors, duplicate accounts, mis-posted late payments, or unknown credit lines. Dispute errors right away and keep proof. You can view and manage your profile with Experian and learn how bureaus build files from D&B.

Build positive data with suppliers

Your score grows faster when more partners report positive activity. Ask key suppliers to share your on-time payment record with commercial bureaus. Add a trade credit account or two that report, then keep them current. Over time, these lines thicken your file and show stability. You can also review general tips from the British Business Bank.

Avoid legal red flags

County Court Judgments, late filings, and insolvency events harm your profile. Prevent issues with tight credit control and early engagement if a dispute arises. If a CCJ appears, settle it as soon as possible and follow the process to show it as satisfied. For borrowers who already have a CCJ, read our article on how to get a business loan with a CCJ.

Governance and admin hygiene for directors

Separate personal and business finances. Open a business bank account, use business credit products, and keep clean records. This creates a clear business credit footprint and reduces noise from personal data.

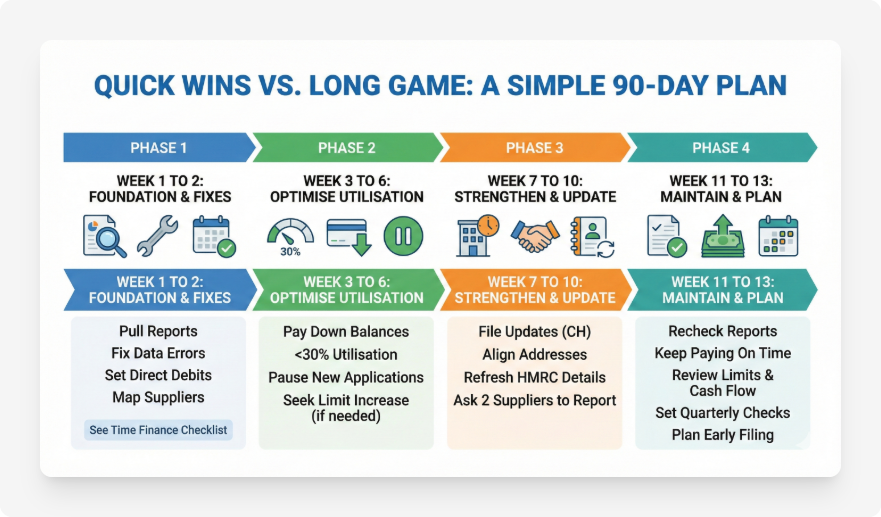

Quick wins vs the long game, a simple 90-day plan

Week 1 to 2: Pull your reports, fix data errors, and set Direct Debits for recurring bills. Map every supplier that reports. See Time Finance’s checklist in this article.

Week 3 to 6: Pay down balances to get under 30 percent utilisation. Pause new credit applications unless essential. If you need more headroom, seek a limit increase on an existing facility.

Week 7 to 10: File any overdue updates at Companies House, align trading and registered addresses, and refresh HMRC contact details. Ask two reliable suppliers to report your positive history.

Week 11 to 13: Recheck reports to confirm fixes, then keep paying on time. Review limits and cash flow, set quarterly report checks, and plan for early filing on the next accounts cycle.

.png)