Capify vs 365 Finance: Which Lender Is Right for Your UK Business?

Access to working capital is changing. Bank lending has recovered from 2023 lows, yet net lending to SMEs remains subdued and many firms still turn to specialist lenders for speed and flexibility. Recent data from UK Finance and the British Business Bank shows gross SME lending rose in 2024, although levels remain below pre-pandemic highs, and smaller businesses continue to seek fast, tailored finance outside the high street.

This guide compares two well-known UK providers: Capify, a multi-product alternative lender offering business loans and merchant cash advances, and 365 Finance, a specialist in revenue-based finance, commonly known as a merchant cash advance. We look at product structures, pricing, eligibility, reviews, and real-world fit, so you can pick the option that matches your cash flow and goals.

The Evolving Landscape of UK SME Finance

SME finance has shifted toward faster, data-driven decisions. Challenger and specialist lenders now serve businesses that want simple applications, quick approvals, and funding in days, not weeks. UK Finance reports gross bank lending to SMEs rose 13% in 2024 to just over £16 billion, yet overall availability is still below pre-pandemic levels, keeping demand strong for alternative routes.

The British Business Bank’s latest market review shows changing patterns in usage. Fewer smaller businesses used external finance through 2024, but aggregate flows held up and challenger banks expanded share. For firms that need capital quickly, alternative lenders remain a practical option, especially when speed or flexibility outweighs headline APR.

In short, if you need a fast decision or repayments that flex with takings, non-bank options like Capify and 365 Finance can play a useful role alongside traditional borrowing.

Product Line-Up and Loan Terms: Capify vs 365 Finance

Capify Business Loans

What it is: Short-term working capital loans with fixed daily or weekly repayments. Capify also offers merchant cash advances, and can offer secured options for larger facilities. Typical unsecured terms range from a few months up to around a year, with rapid decisions and funding.

Sizes and repayments: Capify markets fast and flexible funding, with unsecured and secured choices and funds often arriving within 24 hours after approval. Repayments are automated, spreading cost into smaller, regular debits that smooth cash flow compared to a once-monthly lump sum.

Fees and pricing: Pricing is quoted as a fixed total repay or factor-style cost rather than a variable APR, so you know the full payback at the start. Early repayment usually does not reduce the fixed fee on factor-priced products, which is common across the short-term alternative market.

Eligibility snapshot: At least 12 months’ trading and >£10,000 monthly turnover for loans. For Capify’s MCA, card-takings thresholds apply.

Pros of Capify

• Multiple products in one place, including loans and MCA

• Fast decisions and funding

• Fixed, automated repayments for predictability

• Option to discuss secured structures for larger needs.

Cons of Capify

• Higher entry bar than some MCA specialists

• Factor-style pricing can be costlier than bank loans

• Early payoff typically does not lower the fixed fee.

365 Finance Funding (Merchant Cash Advance)

What it is: Unsecured revenue-based finance repaid via a fixed share of your daily card sales, with no APR or fixed term. 365 advertises £10,000 to £500,000 advances, fast approvals, and cash in days.

How it works: You agree a holdback percentage of card takings. When sales are higher you repay more, and when sales dip you repay less. There are no scheduled monthly payments and no compounding interest, just a fixed total to repay.

Eligibility snapshot: Suits card-taking businesses. 365 highlights a quick application, a named relationship manager, approval in as little as 24 hours, and funding within days.

Pros of 365 Finance

• Repayments flex with sales • Simple online process and very fast decisions • Unsecured, with no APR or fixed term • Well-reviewed customer service.

Cons of 365 Finance

• Single core product, so less choice if MCA is not suitable • Funding capacity is linked to card revenue • Total cost can be higher than a traditional term loan, even if the structure is simpler.

Cost Comparison: What Will Your Loan Really Cost?

Capify loans and merchant cash advances from 365 use fixed-repay models. Instead of quoting a variable APR, the lender sets a total repay figure or fee at the start. That improves certainty, yet you should compare the full payback, any set-up fees, and how the repayment mechanics hit your cash flow. For MCAs, the holdback percentage reduces cash received on each card settlement, which is easier to manage for seasonal firms. For fixed-repay loans, the daily or weekly debit stays constant, which suits predictable cash flows.

Sources: Capify, 365 Finance.

Worked example 1, fixed-repay loan: A retailer borrows £100,000 on a short-term Capify loan with a quoted total repay of £120,000 over 12 months. Daily debits spread the cost into manageable chunks. The certainty helps planning, but early payoff would usually not reduce the fixed fee. Always confirm fees and total repay before you sign.

Worked example 2, revenue-based finance: A café secures £80,000 from 365 Finance with a 12 percent holdback of card takings and a fixed total repay agreed up front. In busy months, they repay faster; in quieter months, less goes out. There is no APR or fixed end date, only a fixed total to clear.

Real-World Use Cases: Which Lender Fits Your Scenario?

Scenario 1: Seasonal hospitality needs a cash flow buffer

A coastal restaurant does most revenue by card and swings seasonally. Variable repayments protect low-season cash flow while capturing more in peak weeks.

Best fit: 365 Finance MCA, where holdback tracks takings.

Why 365 Finance is the better fit

Repayments scale with sales, approvals are very fast, and the structure is simple to manage without fixed monthly bills.

Scenario 2: Established services firm wants a clear schedule

An IT consultancy invoices via bank transfer and prefers a fixed schedule to plan cash outflows.

Best fit: Capify business loan with daily or weekly fixed debits and a clear total repay.

Why Capify is the better fit

Choice of structures in one place, predictable repayments, and the option to discuss secured routes for larger amounts.

How to Qualify & Apply: Your Step-by-Step Guide

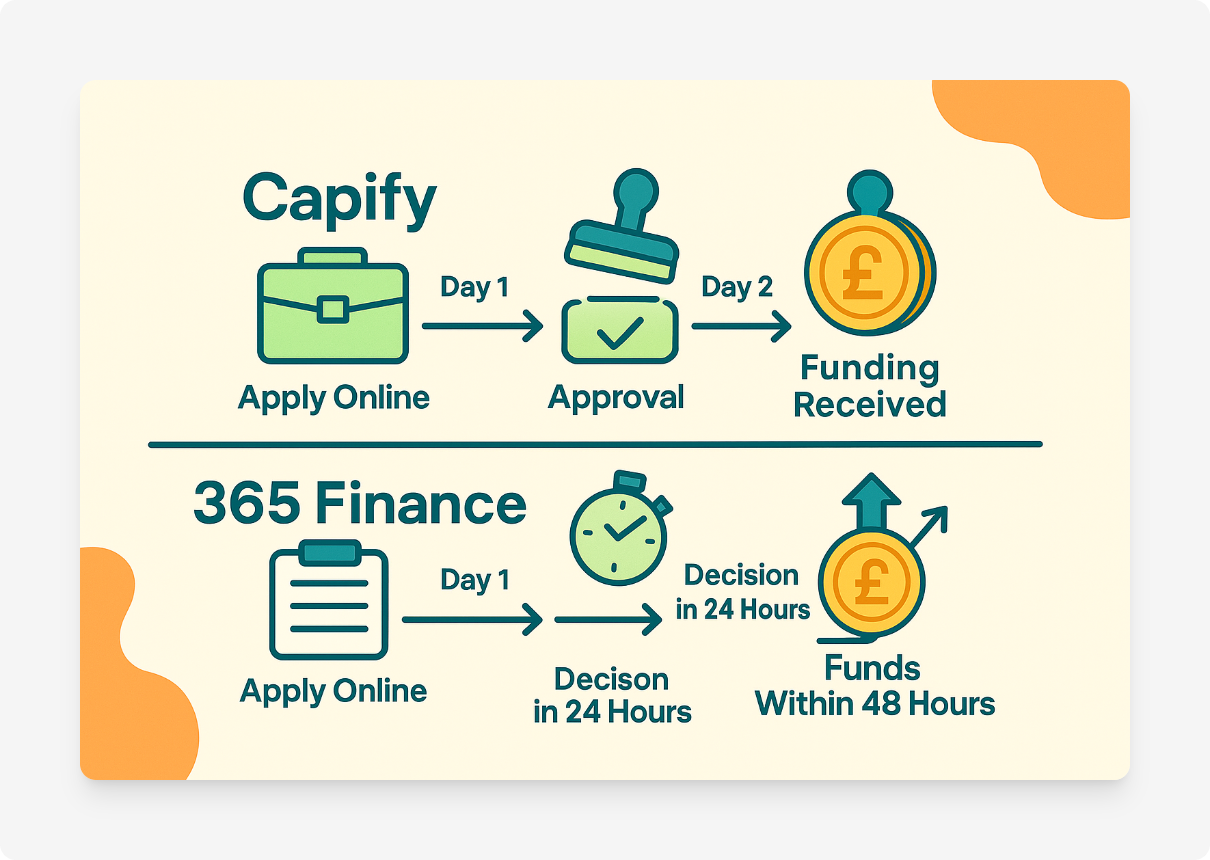

Capify Application Process

Check eligibility online, then share business details and bank statements. Expect a quick decision and, once approved, funds can follow within 24 hours. An account manager guides you through documents and offer acceptance.

Capify Eligibility Criteria

For loans, Capify lists 12+ months trading and monthly turnover above £10,000. For the MCA, minimum card-takings apply. Requirements can vary by sector and amount.

365 Finance Application Process

Apply online in minutes, connect statements or card data, and you will be assigned a relationship manager. Approvals are often in under 24 hours, with cash landing in days.

365 Finance Eligibility Criteria

Best for firms with steady card revenue. Advances from £10,000 to £500,000 are unsecured and repaid from a fixed share of takings.

Customer Reviews & Trustpilot Ratings

Capify: Rated Excellent on Trustpilot, with hundreds of reviews praising speed and helpful account managers.

365 Finance: Also rated Excellent on Trustpilot, with a very high share of 5-star feedback highlighting quick, simple funding and strong service.

Conclusion & Recommendation

Choose Capify if…

• You want a fixed schedule and predictable daily or weekly repayments.

• You do not rely on card takings, or you prefer a term-loan style structure.

• You may need secured options for larger amounts.

• You value having multiple product types from one provider.

Choose 365 Finance if…

• Your revenue is card-heavy and seasonal or variable.

• You want repayments that flex with daily takings.

• You need a very fast, simple, unsecured route.

• You prefer a single, streamlined product with strong service.

Still unsure which route to take? Funding Agent helps UK businesses compare lenders and find the best fit for their cash flow, sector, and growth plan. Start with our quick form and get matched to options across 150+ providers.

References:

- Capify product pages;

- Capify eligibility;

- 365 Finance merchant cash advance;

- 365 Rev&U overview;

- Capify Trustpilot;

- 365 Trustpilot;

- UK Finance SME lending 2024;

- British Business Bank Small Business Finance Markets 2024/25;

- Pollen Street facility for Capify.

.png)