Funding Circle vs Nucleus Commercial Finance: The 2025 Guide for UK SMEs

Fast finance can make or break a growing company. Two fintech lenders now lead the UK scene: Funding Circle and Nucleus Commercial Finance. Both promise quick decisions and flexible capital, yet their models, costs, and ideal borrowers differ. This 2025 guide explains each option in plain language so you can choose the right fit.

At-a-Glance Snapshot

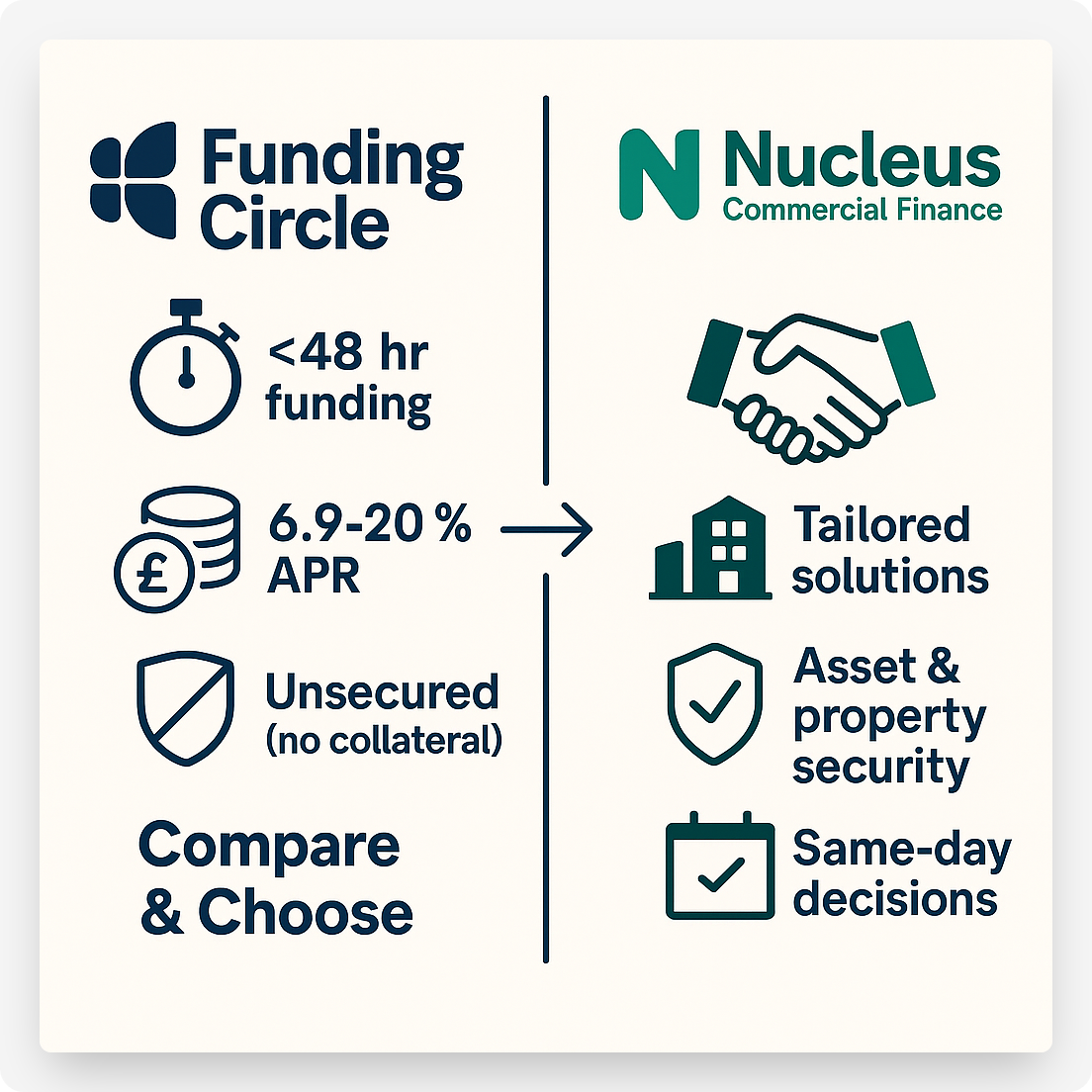

- Funding Circle, marketplace lender focused on unsecured term loans up to £750 000; decisions often in under an hour.

- Nucleus Commercial Finance, balance-sheet lender offering loans, invoice finance, asset finance, and more; approvals often instant for simple deals.

- Both require personal guarantees; Nucleus can also take specific collateral for bigger or riskier deals.

Product Range and Flexibility

We chart each lender’s products on a 0–5 scale. Five means full coverage; zero means none. Funding Circle peaks at five for term loans and four for lines of credit. It also offers a credit card at three, but it does not cover asset, invoice, merchant cash advance, or property finance. Nucleus matches Funding Circle on loans and credit lines, then extends its reach with a top score of five for asset and invoice finance, plus four-point ratings for merchant cash advances and property finance. It does not offer a credit card. This view highlights Funding Circle’s streamlined focus versus Nucleus’s full-spectrum toolkit.

Funding Circle: streamlined term finance

Funding Circle built its name on one product, the unsecured term loan. Borrow between £10 000 and £750 000, choose a term from six months to five years, sign online, and receive funds in one to two days. Complementary tools now sit beside the core loan. A short-term six-to-twelve-month facility helps younger firms, while FlexiPay offers a revolving line up to £250 000 with up to 90 days interest-free. For everyday spending the Funding Circle cashback card rounds out the package. The lender does not provide asset finance or invoice finance; instead it refers clients to partners. That laser focus keeps the user journey quick and simple. (See Funding Circle Trustpilot Reviews)

Nucleus: one-stop shop for many needs

Nucleus positions itself as a finance supermarket. The standard unsecured loan reaches £500 000 over three to six years, but the menu also includes secured loans up to £2 million, invoice finance that advances up to 90 percent of an invoice, asset finance for equipment, merchant cash advances repaid through card sales, and revenue-based loans that flex with turnover. This breadth lets Nucleus solve complex cash-flow puzzles, such as a mixture of an asset purchase and working-capital top-up in one package. (Nucleus Trustpilot Reviews)

Rates and Fees

Funding Circle advertises fixed rates from 6.9 percent for top-grade firms. Most borrowers pay about 11 to 12 percent APR, risk-adjusted across five credit bands. An upfront “completion fee” of three-to-six percent applies once, and there are no early-repayment penalties.

Nucleus prices case by case. Unsecured loans usually sit between nine and 18 percent APR, with prime clients dipping into single digits and higher-risk cases approaching 20 percent. Asset-backed deals can cost as little as six percent, while a merchant cash advance might equate to 20 to 40 percent once the factor rate is translated into APR. (Finder overview) Because pricing adapts to collateral, term, and sector, you must request a quote, but flexibility often offsets the slightly higher cost.

Speed and User Experience

Funding Circle’s application form takes about seven minutes. The platform pulls data from Companies House, credit bureaus, and open-banking feeds. Around 70 percent of applicants receive a decision on the spot, and simple loans can fund within 48 hours. Approval is algorithm-led with human oversight, so edge cases may still get a call from an underwriter, but the journey stays mostly digital.

Nucleus matches that pace for straightforward requests. Its AI engine issues decisions in under one minute for 96 percent of applications, thanks to real-time bank-feed analysis. Same-day funding is common, and a human credit team steps in only when nuance is needed, for example a seasonal repayment profile or a mix of facilities.

Eligibility and Ideal Borrower

Funding Circle

- At least one full year of trading, two years preferred.

- Turnover usually £100 000 plus; solid credit profile.

- Best for established limited companies that need a plain term loan and value speed. Full Funding Circle review

Start-ups, very thin-credit firms, and companies with recent losses still struggle to pass the automated scorecard.

Nucleus

- Welcomes younger or seasonal firms; some products start at £50 000 turnover.

- Considers collateral, growth forecast, and sector quirks such as construction stage payments.

- Suited to businesses needing bespoke structures or a blend of facilities. Full Nucleus review

The lender’s “solution-first” culture means a decline on one product can still yield an offer on another, for example part loan, part invoice-finance line.

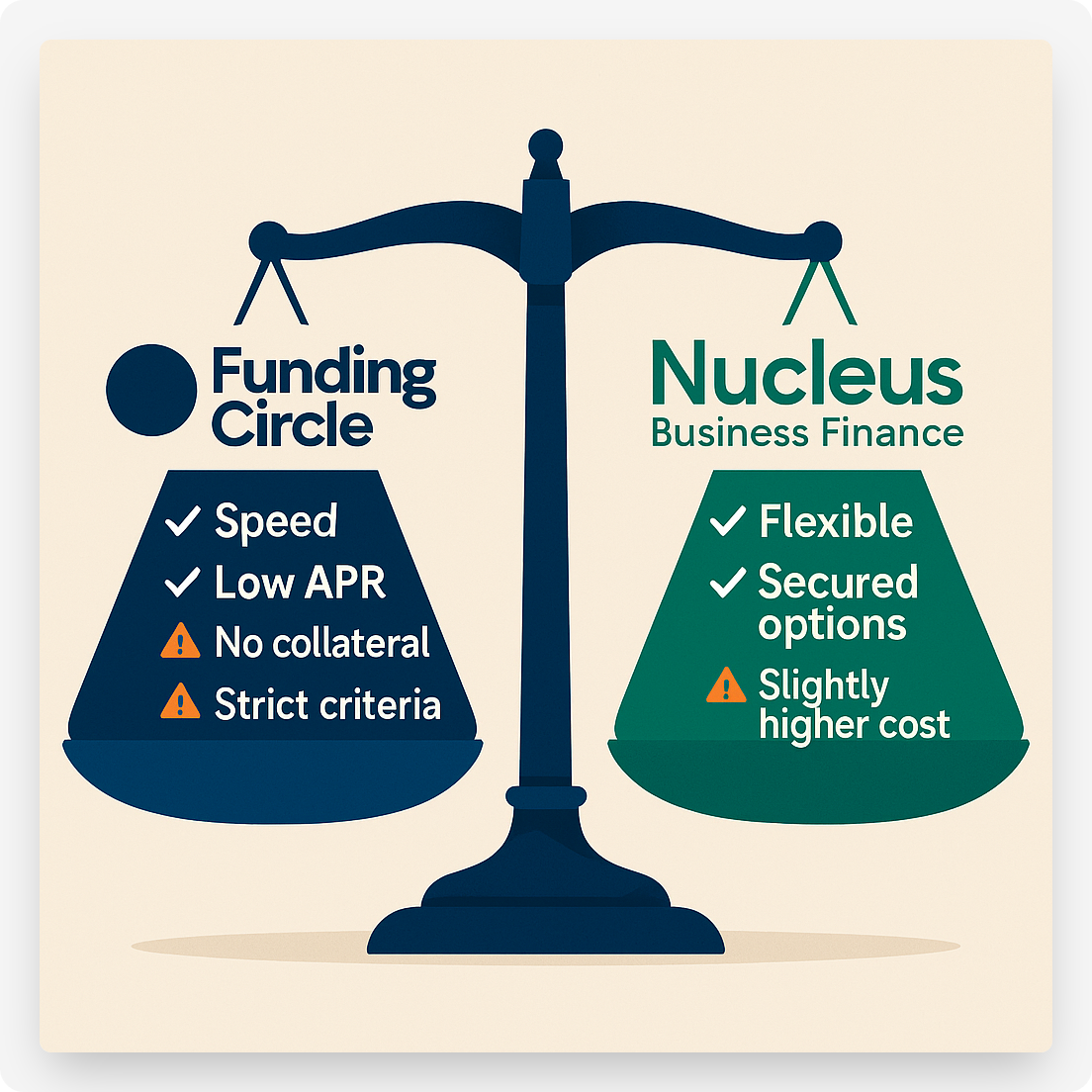

Pros and Cons

Use-Case Scenarios

You need £100 000 to stock inventory fast

If your accounts look strong and you want fixed monthly repayments, Funding Circle is the straight road. Apply Monday morning, money could land Wednesday.

You want £250 000 to buy equipment and smooth cash flow

Nucleus can mix an asset-finance agreement with an unsecured top-up so you avoid two separate lenders. The credit team will adjust term lengths to match the equipment life. Learn about asset finance

Your firm is young but growing fast

With only twelve months trading you may miss the Funding Circle cut-off. Nucleus may still accept you, especially if directors give homeowner guarantees and real-time bank data proves upward momentum.

Market Context and Regulation

Alternative lenders are no longer fringe. Challenger and specialist banks provided more than half of all UK SME lending in 2022, according to the British Business Bank SME Finance Markets Report. Both Funding Circle and Nucleus joined government schemes such as CBILS and the ongoing Recovery Loan Scheme, proving their ability to scale responsibly.

The 2023 Consumer Duty now pushes lenders to show good outcomes for small firms; both brands already highlight transparent pricing and fast support. Expect further tech upgrades and green-finance products as regulation rewards efficiency and sustainability.

Action Plan: Picking Your Winner

- Define your goal. Is it a one-off expansion loan, ongoing working capital, or a mix? Simple term needs align with Funding Circle; multi-layer needs lean toward Nucleus.

- Gather data. Export six months of bank transactions and latest accounts. Both lenders use open banking, and clean data speeds approval.

- Apply to both. Quotes are free and soft-search at first, so a side-by-side offer lets you compare true cost.

- Negotiate. If Nucleus gives a higher rate on an unsecured loan, ask whether providing a charge on equipment can trim the price. If Funding Circle caps you at £250 000, consider taking that for the unsecured slice and adding Nucleus for any asset element.

- Plan your exit. Both allow early repayment without penalty. When a cheaper bank facility becomes available, switch, and keep your cost of capital low.

Looking Ahead

The rivalry between Funding Circle’s slick scale model and Nucleus’s flexible toolbox is healthy for UK SMEs. Competition drives quicker decisions, sharper pricing, and smarter risk tools powered by open banking and AI. In the next two years we expect:

- More sector-specific products, such as “green upgrade” loans that blend equipment finance with term debt.

- Deeper integration into accounting software, cutting manual uploads entirely.

- Greater publication of outcome data, showing how borrowers grow revenue and jobs after taking a loan. See alternative-finance examples

Final Thoughts

Funding Circle and Nucleus both turn the once slow loan hunt into a digital sprint. Choose Funding Circle for quick, no-frills term lending at keen rates. Choose Nucleus when you need a lender that listens, tweaks, and layers products to suit your plan. Either way, UK SMEs now have power in the lending market, use it.

.png)