Swoop Funding vs Funding Options: A Detailed Comparison for UK SMEs

If you run a UK business and need funding, two names will keep appearing in search results, Swoop Funding and Funding Options by Tide. Both are FCA regulated brokers that match SMEs to lenders, rather than lending their own money, but they solve the funding problem in slightly different ways.

This guide walks through each of the main sections covered in the research report, from basic profiles and product ranges through to lender panels, speed, fees and real world use cases, so you can decide which broker is likely to fit your business best.

Swoop Funding vs Funding Options Interactive Data Visualizer

Here is the comparison in numbers, not just marketing copy. Explore the tabs to see how Swoop Funding and Funding Options stack up on product coverage, pricing, limits, speed and fit for different SME use cases.

Basic broker profiles

Swoop Funding at a glance

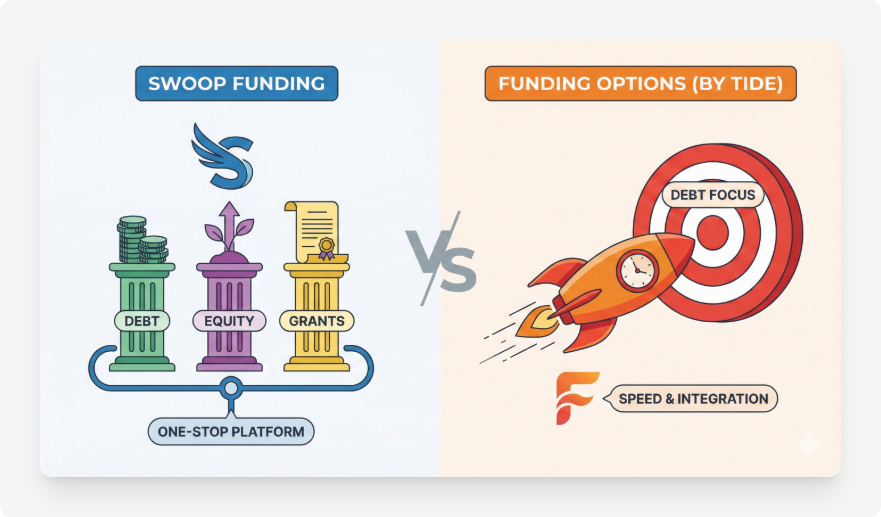

Swoop Funding is the trading name of Swoop Finance Limited, an FCA authorised credit broker and registered open banking Account Information Service Provider. Founded in 2018 and headquartered in London, Swoop positions itself as a one stop funding and savings platform for UK and Irish SMEs, with additional reach into markets such as North America, Australia and South Africa.

Instead of being a lender, Swoop connects businesses to loans, equity investors and grant providers through a single digital platform. Their pitch is simple, one application, thousands of potential options, with AI powered matching supported by human funding managers when you need help.

Funding Options by Tide at a glance

Funding Options Limited, now branded as Funding Options by Tide, has been operating since 2011 and is also based in London. It is FCA authorised as a credit broker and was chosen as one of the official government platforms under the UK Bank Referral Scheme.

Funding Options focuses firmly on debt finance for trading SMEs within the UK, from sole traders and micro businesses up to medium sized firms. The company uses its “Funding Cloud” technology and open banking data to match applicants with a panel of banks and alternative lenders in near real time. Since being acquired by Tide, its marketplace is deeply integrated into the Tide business banking app, a relationship covered in more detail in this industry write up.

Product coverage, what each broker can arrange

Both brokers cover the main types of UK business finance you would expect, unsecured and secured loans, working capital facilities, asset finance and invoice finance. Swoop’s proposition stretches further into equity and grants, while Funding Options stays laser focused on loans and other credit products.

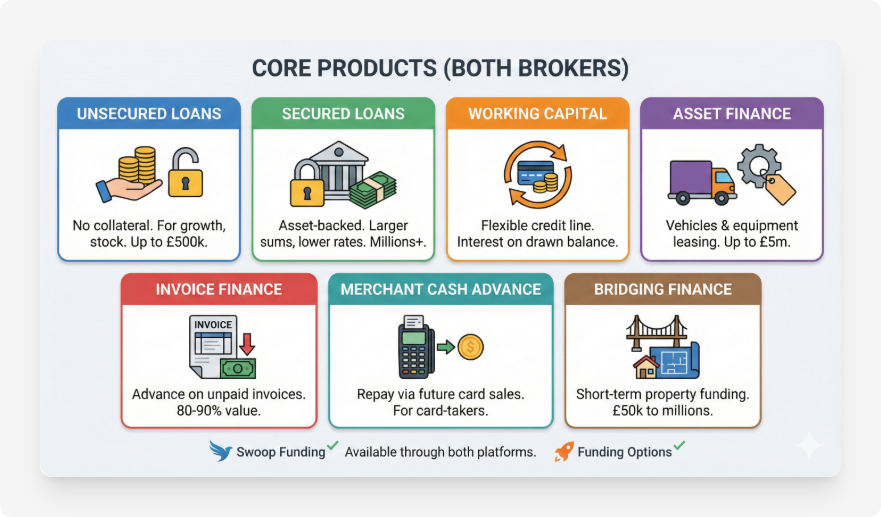

Core products offered by both

- Unsecured business loans. Both platforms arrange unsecured term loans that do not require physical collateral. In practice these are used for working capital, marketing, stock and general growth, with typical maximums around five hundred thousand pounds and personal guarantees as standard.

- Secured business loans and commercial mortgages. For larger sums or lower rates, both brokers can arrange loans secured on property or business assets. Ticket sizes can run into the millions, particularly for commercial mortgages and property deals.

- Working capital and revolving credit. Short term working capital is usually delivered via unsecured loans, revolving credit lines or overdraft style facilities. Both Swoop and Funding Options offer these, often with interest charged only on the drawn balance.

- Asset finance. Hire purchase and leasing for vehicles, machinery and other equipment is a key part of both panels. Typical amounts range from a few thousand pounds up to five million pounds, with terms aligned to the useful life of the asset.

- Invoice finance. Both brokers can connect you with invoice factoring and invoice discounting providers, usually advancing around eighty to ninety percent of invoice value to businesses with at least low six figure annual turnover.

- Merchant cash advances. For card taking businesses, both platforms have merchant cash advance partners, where you trade a share of future card sales for an upfront advance.

- Bridging and development finance. Each broker has access to short term bridging loans and development finance for property investors and developers, with loan sizes that can run from fifty thousand pounds into the tens of millions.

Products where Swoop goes further

- Government Start Up Loans. Swoop can help eligible founders access official UK Start Up Loans, fixed at six percent interest, for new or very young businesses that may not yet qualify for traditional bank lending.

- Equity finance. Swoop has an extensive network of angel investors, venture capital funds and crowdfunding platforms. The platform can support equity raises for high growth startups as well as more established companies.

- Business grants. Swoop also maintains a grants database and offers support with identifying and applying for relevant grant schemes, from Innovate UK programmes to local authority support.

- Business credit cards and savings. Through its compare and save tools, Swoop also helps businesses review business current accounts, savings products and credit cards to reduce costs, something that sits outside Funding Options’ core remit.

Products where Funding Options pushes depth

Funding Options concentrates on being a deep marketplace within the world of credit. Its panel includes specialist lenders for trade finance, revenue based finance for ecommerce sellers, niche asset finance and a wide range of secured and unsecured loan structures. If your requirement is definitely a loan rather than equity or grant funding, FO’s tightly focused panel is designed to surface multiple competing options from lenders that specialise in your niche.

Typical interest rates, terms and loan sizes

Because both brokers work with panels of lenders, rates are set by the lenders rather than by Swoop or Funding Options themselves. The report summarises typical ranges that you might see on each platform for key product types. Exact pricing depends on your credit profile, security and the lender’s risk appetite, but the ranges give a useful benchmark.

Summary of rate and term ranges

- Unsecured loans. Representative annual percentage rates run from the mid single digits for strong, established borrowers up into the high twenties or low thirties for newer or higher risk firms. Terms are usually between six months and five years, with amounts from around one thousand to five hundred thousand pounds depending on the broker and lender.

- Secured loans and commercial mortgages. Secured borrowing tends to start around four percent per year for lower risk, well secured deals and can stretch into the low teens for more complex or highly geared structures. Terms can span one to ten years for general secured loans and extend beyond ten years for commercial mortgages. Funding Options quotes maximum secured facilities up to around twenty million pounds, while Swoop’s typical range is up to five million pounds for secured loans, with larger bespoke deals possible via its network.

- Asset finance. Effective APRs usually fall somewhere between roughly five and twenty five percent, depending on the asset, deposit and credit quality. Terms align to asset life, most commonly three to five years.

- Invoice finance. Costs are expressed as discount and service fees rather than APR, often adding up to the equivalent of mid single digit to low double digit annualised rates. Advance rates tend to sit around eighty to ninety percent of invoice value, with facility sizes running from tens of thousands into the millions.

- Merchant cash advances. Instead of interest, MCAs use a fixed payback multiple, for example repaying one point one to one point five times the amount advanced. The effective APR can be in the teens through to forty percent or more, depending on how quickly your card sales repay the balance.

- Revolving credit lines. Monthly interest on the drawn balance typically ranges from around half a percent for low risk cases up to several percent per month for higher risk situations, giving approximate APRs from the mid single digits up to thirty or forty percent. Facility limits can range from just a few thousand pounds to several million.

- Bridging and development finance. Bridging rates generally sit between around half a percent and one and a half percent per month, with interest usually rolled up. Both platforms can support significant property transactions, with Funding Options quoting facilities up to around twenty five million pounds and Swoop indicating access to deals up to fifty million pounds or more through specialist partners.

- Government Start Up Loans through Swoop. These are fixed at six percent per year with terms up to five years, and maximum exposure of twenty five thousand pounds per founder, subject to eligibility.

The key takeaway is that both marketplaces can deliver very sharp pricing to strong borrowers and also have options for higher risk situations where you will pay more for flexibility. The broker’s job is to steer you toward the lenders whose risk appetite and pricing best fit your profile.

Lender panels and partner networks

Behind each marketplace sits a panel of banks, alternative lenders and, in Swoop’s case, investors and grant bodies. The breadth and depth of these relationships ultimately determines which options you actually see. Funding Options’ panel is tightly integrated with Tide and was used in the UK Bank Referral Scheme.

Panel size and composition

- Swoop Funding. Swoop reports working with more than one thousand funding providers. That figure covers a mix of high street banks, challenger banks, alternative lenders, asset finance houses, invoice finance providers, merchant cash advance firms, equity investors and grant bodies. The network includes mainstream names as well as niche specialists and regional funds.

- Funding Options. Funding Options quotes a panel of around eighty to one hundred and twenty lenders, all of which are credit providers rather than equity or grant funders. The roster covers high street and challenger banks, alternative lenders, merchant cash advance firms, asset based lenders and property finance specialists.

Equity, grants and special partnerships

- Swoop’s extended ecosystem. Because Swoop includes venture capital funds, angel networks, crowdfunding platforms and grant agencies within its “funding provider” count, it can support journeys that go beyond pure debt. It has also been backed by institutional investors and has secured government competition remedy funding to expand its SME offering, which reinforces its position in the UK fintech ecosystem.

- Funding Options’ Tide integration and bank referral role. Funding Options’ most notable partnership is with Tide, where its marketplace is embedded directly into the bank’s app for hundreds of thousands of UK SMEs. It was also one of the original platforms chosen under the Bank Referral Scheme, meaning large banks send declined SME applications to FO so that alternative lenders can be considered.

In practice, both brokers can introduce you to a wide range of reputable lenders for most borrowing needs. Swoop’s panel is broader in absolute terms, particularly once you include equity and grants. Funding Options focuses its relationships on debt providers and leverages those relationships to deliver speed and depth within that slice of the market.

Application journey, speed and user experience

Both brokers lean on Open Banking and data integrations to cut down paperwork. Funding Options pushes pure speed very hard via its Funding Cloud technology, while Swoop invests more in an ongoing funding and savings dashboard.

How applications work

- Swoop Funding. You create an account, complete a funding profile and are encouraged to connect your business bank account via open banking, and sometimes your accounting software, so that Swoop can analyse real time financial data. Supporting documents can be uploaded where needed. The platform then generates suggested matches which a funding manager can refine with you.

- Funding Options. You complete a short online form, either on FO’s website or inside the Tide app. Funding Cloud technology uses open banking and data from sources such as Companies House to assess eligibility across the panel. The application is designed to be completed in just a few minutes.

Speed from application to offers and to funding

- Time to initial offers. Both platforms can present indicative matches very quickly once your data has been submitted. Funding Options pushes speed hardest, with marketing that highlights matches in under a minute and, in some cases, automated lender decisions within minutes. Swoop generally talks about matches within minutes rather than seconds, but the difference is marginal in everyday terms.

- Time to money in the bank. For straightforward unsecured loans, both brokers report cases where funding has been completed within twenty four hours. Typical timelines are one to three working days for uncomplicated deals, stretching into weeks or months for complex property or equity transactions.

Human support and dashboards

- Advisor involvement. Both services offer free human support. In practice, most customers will speak with a dedicated advisor at some point. Swoop assigns funding managers who help interpret options across loans, equity and grants. Funding Options model has always included broker style advisors who call quickly after matches are generated to talk through the terms.

- Online portals. Swoop offers a more comprehensive online dashboard where you can view funding options, track applications and explore additional savings tools. Funding Options provides a clean application interface and integrates neatly into the Tide app, but once offers have been generated, much of the process continues via advisors and directly with the lenders.

Overall, Swoop feels like a richer funding platform that you can log in to and manage over time, while Funding Options feels like an extremely fast comparison engine for debt that is backed by hands on broker support.

Fees, pricing transparency and commissions

For many business owners, one of the first questions is, what will this service cost me. The short answer in both cases is that you do not pay the broker directly. Both Swoop and Funding Options are paid by lenders through commissions and finder’s fees when a deal completes.

- No direct fees to SMEs. Neither broker typically charges UK SMEs any upfront or ongoing fee for their standard brokerage service. You can apply, compare options and even speak to advisors without a bill from the broker.

- Commission based models. Each broker earns commission from the lender that provides your funding. This may be a percentage of the loan amount, a share of the interest margin or a fixed referral fee. Exact commission structures vary by lender and are not disclosed on a lender by lender basis, which is standard across the industry.

- Transparency. Both firms clearly state that they are credit brokers, not lenders, and that they are paid by providers rather than charging SMEs. They also highlight that checking your options is free and does not affect your credit score, because only soft searches are used at the marketplace stage; a hard search is performed only by the lender you decide to proceed with.

From a user perspective, the important point is that there is no separate brokerage line item for you to pay. Any arrangement fees you see will be charged by the lender as part of the loan itself, and you should compare those alongside rate, term and other conditions when choosing between offers.

Eligibility criteria and ideal customer profiles

Both brokers exist to serve a broad base of UK SMEs, but their panels have slightly different sweet spots. The report summarises typical eligibility guidelines for each.

Trading history and turnover

- Swoop Funding. Many of Swoop’s loan providers look for at least six to twelve months of trading and annual turnover from around fifty to one hundred thousand pounds and upwards. However, because Swoop also works with Start Up Loans, equity investors and grant bodies, it can support pre revenue and very young businesses through those channels.

- Funding Options. Funding Options is strongest for trading businesses with at least several months of revenue history and established turnover. Its lenders often want six months or more trading and minimum annual sales in the tens of thousands of pounds, higher for larger facilities.

Startups and poor credit

- Startups. Swoop is notably more startup friendly, due to its ability to work with the government Start Up Loans scheme and connect founders with equity investors and grants. Funding Options can sometimes help very young businesses find lenders willing to lend against projections and personal guarantees, but its main focus is on businesses that are already trading.

- Poor credit. Both brokers have lenders on their panels that will consider applicants with weaker credit profiles, usually at higher rates and with strong emphasis on personal guarantees, security or cash flow. If your credit history is severely impaired or you are in an insolvency process, neither marketplace will be able to help until issues are resolved.

Deal sizes and sectors

- Deal sizes. Swoop regularly arranges funding from as little as a few thousand pounds up to multi million facilities, especially for property and equity transactions. Funding Options core sweet spot is also in the tens of thousands to low millions range, particularly for unsecured and secured loans, with property facilities extending higher.

- Sectors. Both brokers are broadly sector agnostic and cover everything from ecommerce and technology through to retail, hospitality, manufacturing and property. Each works with lenders that exclude certain high risk or prohibited sectors, for example gambling or weapons, and will signpost you if your sector is outside policy.

Customer reviews, trust and overall comparison

The report also summarises Trustpilot scores and qualitative feedback for each broker across key dimensions such as user experience, speed, transparency and customer satisfaction.

- User experience. Swoop scores slightly higher for its rich dashboard and ability to manage loans, equity and cost savings in one portal. Funding Options still earns a strong rating, especially for the simplicity of its application journey and its seamless integration with Tide, but the online portal itself is more limited once offers are produced.

- Speed. Both brokers are fast, but Funding Options takes a narrow lead on pure speed to decision, thanks to its highly automated Funding Cloud engine and lender integrations. It has documented cases of decisions in minutes and funding within a day for straightforward loans.

- Transparency and trust. Both Swoop and Funding Options are rated highly for being open about their role as brokers, not lenders, and for making it clear that their service is free to SMEs. Trustpilot scores sit around four point eight out of five for each, with Swoop’s profile shown on Trustpilot and Funding Options rated on its own Trustpilot page, which is impressive given the number of reviews Funding Options has built up over a longer period.

- Customer satisfaction. Feedback is overwhelmingly positive for both companies, with reviewers frequently praising the helpfulness of individual advisors and the ease of the process compared with going bank to bank.

Put simply, this is not a contest between a good broker and a poor one, but a comparison of two strong options with slightly different strengths.

Which broker is better for you, scenario guide

The original report closes with practical scenarios to illustrate when each broker may be the better fit. Here is a condensed version.

- Scenario 1, you are a startup under one year trading or need equity or grants. Swoop is the natural choice because it can support government Start Up Loans, equity fundraising and grant applications alongside traditional loans.

- Scenario 2, you need around fifty thousand pounds very quickly to capture an opportunity. Funding Options has a slight edge on speed for straightforward working capital loans, with a track record of near instant decisions and funding within a day or two for eligible borrowers.

- Scenario 3, you want to explore every possible route to funding, including equity and free money. Swoop broader marketplace and integrated grant and investor search make it better suited if you want to explore multiple funding strategies over time.

- Scenario 4, you are a trading SME who knows you need a loan and wants quick, comparable offers. Funding Options is designed exactly for this use case, surfacing multiple offers from a curated panel of loan providers and guiding you through them.

- Scenario 5, you have a complex requirement such as a large property development or structured finance deal. Both brokers have access to specialist lenders in this space. Swoop may be attractive if you also want to consider equity or mezzanine options alongside debt. Funding Options is strong where the requirement is clearly debt only and speed is still a priority.

Final thoughts

For a UK SME owner, the choice between Swoop Funding and Funding Options does not have to be either or. Both are free to use and both can open doors to lenders that you may not have discovered on your own. The right broker depends on whether you want maximum breadth of funding types or maximum speed and focus for loans.

If you are a startup, need equity or grants, or want a portal you can revisit as your funding strategy evolves, Swoop is likely to be the better fit. If you are an established trading business that knows it needs a loan and wants rapid, comparable offers from a curated panel, Funding Options by Tide will probably feel like the more natural choice.

In many cases it can be worth speaking with both, provided you manage your applications so that lenders are not receiving duplicate submissions. Used thoughtfully, these platforms can be powerful tools in your overall funding strategy and can save significant time compared with approaching lenders one by one.

.png)